In her latest budget presentation, India's Finance Minister Nirmala Sitharaman has announced a series of initiatives focusing on higher infrastructure spending and domestic manufacturing support amidst increasing global uncertainty. As per the Economic Survey, India is on track to achieve a 7.4% GDP growth for the financial year, with projections showing a slight slowdown in the following year due to external economic pressures.

The budget emphasizes fiscal discipline, aiming to lower the fiscal deficit as the government shifts its focus from yearly deficits to an overall debt-to-GDP ratio, targeting a reduction from 56% to 50% by 2030. Among the key provisions are elevated capital spending aimed at infrastructure—road, rail, and port projects, which have been a historical focus under Narendra Modi's government, seeing an increase to 12.2 trillion rupees.

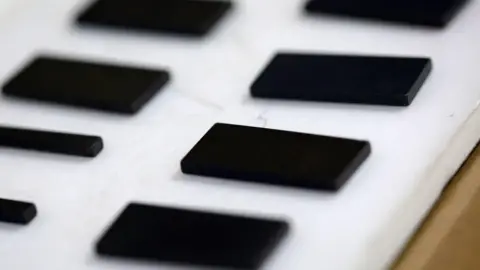

Moreover, as global geopolitical tensions escalate, the budget allocates over a 20% increase in defense expenditures. A push for manufacturing in vital sectors such as rare earths and semiconductors is also highlighted, with plans to set up dedicated corridors for rare earth minerals in several states.

To attract cloud service investments, a long-term tax holiday up to 2047 is proposed, signaling India's increasing allure for foreign investment, particularly in technology and data centers. However, no new direct tax cuts were announced for personal incomes as the Modi government focuses on fiscal restraint and previously established tax policies.

While markets reacted with disappointment following the budget announcement, with concerns over increased transaction taxes on trading securities, the budget sets a clear path towards strengthening India's economic resilience in a challenging global landscape.

The budget emphasizes fiscal discipline, aiming to lower the fiscal deficit as the government shifts its focus from yearly deficits to an overall debt-to-GDP ratio, targeting a reduction from 56% to 50% by 2030. Among the key provisions are elevated capital spending aimed at infrastructure—road, rail, and port projects, which have been a historical focus under Narendra Modi's government, seeing an increase to 12.2 trillion rupees.

Moreover, as global geopolitical tensions escalate, the budget allocates over a 20% increase in defense expenditures. A push for manufacturing in vital sectors such as rare earths and semiconductors is also highlighted, with plans to set up dedicated corridors for rare earth minerals in several states.

To attract cloud service investments, a long-term tax holiday up to 2047 is proposed, signaling India's increasing allure for foreign investment, particularly in technology and data centers. However, no new direct tax cuts were announced for personal incomes as the Modi government focuses on fiscal restraint and previously established tax policies.

While markets reacted with disappointment following the budget announcement, with concerns over increased transaction taxes on trading securities, the budget sets a clear path towards strengthening India's economic resilience in a challenging global landscape.