Adrienne Martin and her family are starting the New Year off without healthcare.

The 47-year-old Texas mother had to make a difficult choice when she found out her monthly healthcare premium was increasing in 2026 from what she described as a manageable $630 (£467) to an unaffordable $2,400 (£1,781).

Her husband depends on an IV medication to treat a blood-clotting disease that costs $70,000 a month without insurance. Knowing their benefits would expire, the family stockpiled the drug to survive the first few months of the year.

It would be like paying two mortgage payments, she said of the new monthly price for healthcare. We can't pay $30,000 for insurance a year.

Ms Martin and her family are not the only ones facing this conundrum. Millions of Americans will see their healthcare bills skyrocket when these subsidies, which were provided through the Affordable Care Act (ACA), also known as Obamacare, expire.

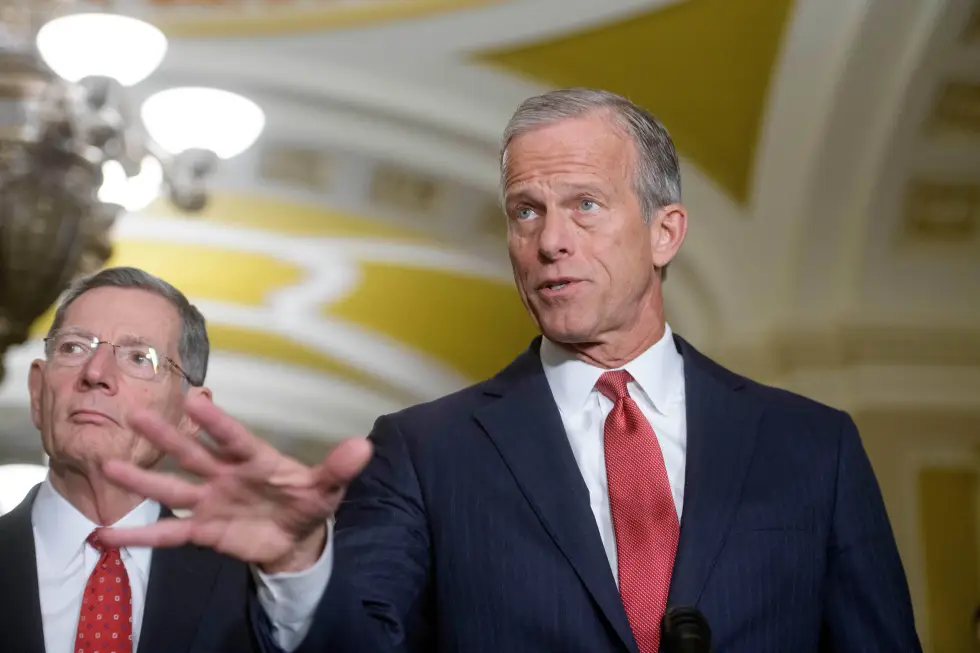

Some members of Congress on both sides of the aisle attempted to extend these subsidies into 2026, but Washington was gridlocked. A vote in the new year could offer hope, but until then, many like Ms Martin will have to live without insurance or see their bills steeply increase.

About 24 million Americans buy health insurance through the ACA marketplace, and the majority were used to receiving tax credits to lower the monthly price.

Those tax credits, also referred to as subsidies, were first introduced through former President Barack Obama's ACA in 2014. They were then expanded during COVID.

The fight to extend the subsidies became the center of the longest government shutdown in US history, which went on for more than 40 days earlier this year.

Democrats wanted to force Republicans to extend the subsidies for an additional three years, which would cost $35bn per year. Republicans did not want the government to foot the bill for another three years of subsidies without spending cuts.

Without the subsidies, the monthly cost of healthcare could rise by 114% on average, according to health research non-profit KFF.

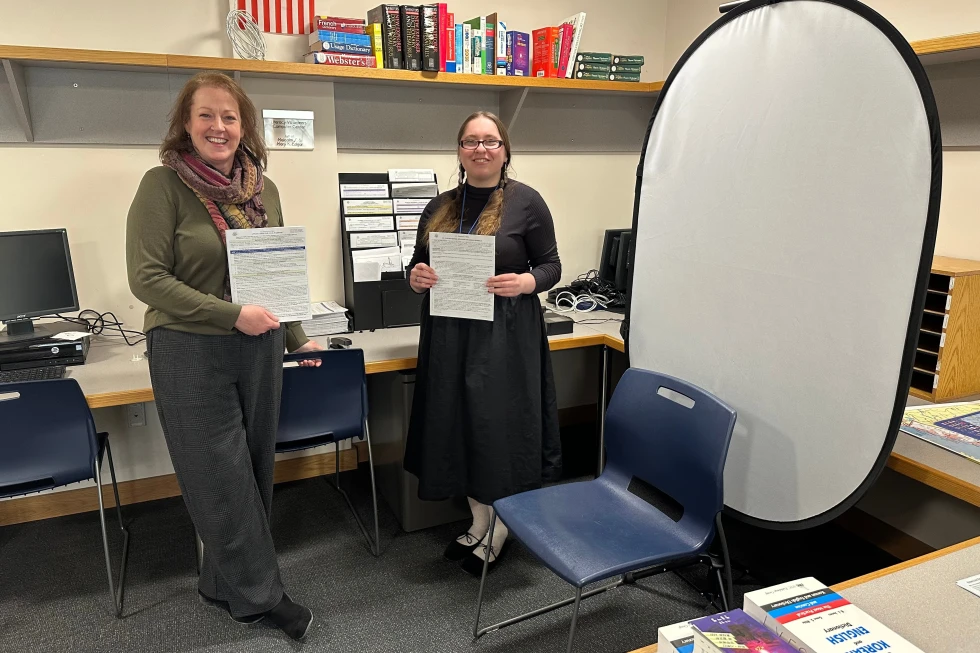

For Maddie Bannister, who just had her second child, the adjustment is stark; her family's insurance premium skyrocketed from $124 to $908 a month.

Others, like Stephanie Petersen, are returning to Medicaid due to surging healthcare costs, facing a healthcare transition that reflects the broader struggles affecting many families as they navigate this financial landscape.