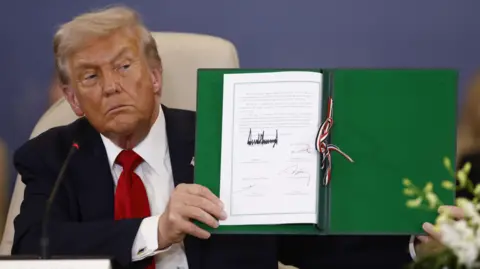

The signing ceremony at the White House took place on the eve of the 4th of July, aligning with celebrations commemorating American independence. Trump has been actively promoting the bill as a catalyst for economic growth, despite mixed public reception reflected in polls showing skepticism among Americans.

The bill incorporates a series of controversial provisions, including:

- Extension of 2017 tax cuts

- Cuts to Medicaid funding, impacting low-income and disabled individuals

- New tax incentives for overtime and Social Security

- An increase in defense spending by $150 billion

- Reduced clean energy tax credits from the Biden administration

- A significant allocation of $100 billion for Immigration and Customs Enforcement (ICE)

The bill's passage was marked by a contentious atmosphere in Congress, culminating in a close House vote that saw only two Republicans voting against it, alongside a united Democratic opposition. Following the vote, Trump expressed confidence at a rally in Iowa, indicating that the bill represents a robust step toward achieving economic strength, national security, and stricter immigration control.

However, experts are concerned that the tax cuts may worsen the nation’s growing budget deficit, with predictions from the Congressional Budget Office indicating that while benefits may appear initially, they could lead to long-term fiscal issues. Critics argue that the bill predominantly favors wealthier Americans, with a Tax Policy Center analysis indicating around 60% of benefits would accrue to those earning above $217,000.

As the nation grapples with the implications of the bill, many Americans are anticipating cuts to essential programs like SNAP, which supports millions in need. With a striking low approval rating for the bill among the general public, the upcoming implementation phase faces scrutiny as lawmakers defend their positions amid internal party disputes and contrasting public sentiments.

The bill incorporates a series of controversial provisions, including:

- Extension of 2017 tax cuts

- Cuts to Medicaid funding, impacting low-income and disabled individuals

- New tax incentives for overtime and Social Security

- An increase in defense spending by $150 billion

- Reduced clean energy tax credits from the Biden administration

- A significant allocation of $100 billion for Immigration and Customs Enforcement (ICE)

The bill's passage was marked by a contentious atmosphere in Congress, culminating in a close House vote that saw only two Republicans voting against it, alongside a united Democratic opposition. Following the vote, Trump expressed confidence at a rally in Iowa, indicating that the bill represents a robust step toward achieving economic strength, national security, and stricter immigration control.

However, experts are concerned that the tax cuts may worsen the nation’s growing budget deficit, with predictions from the Congressional Budget Office indicating that while benefits may appear initially, they could lead to long-term fiscal issues. Critics argue that the bill predominantly favors wealthier Americans, with a Tax Policy Center analysis indicating around 60% of benefits would accrue to those earning above $217,000.

As the nation grapples with the implications of the bill, many Americans are anticipating cuts to essential programs like SNAP, which supports millions in need. With a striking low approval rating for the bill among the general public, the upcoming implementation phase faces scrutiny as lawmakers defend their positions amid internal party disputes and contrasting public sentiments.