Evergrande, once heralded as China's leading property developer, will see its shares removed from the Hong Kong stock exchange on Monday, capping off a trading history spanning over 15 years. This delisting signifies the disheartening failure of a company that once boasted a market value exceeding $50 billion. Analysts deem this action as definitive, stating that "once delisted, there is no coming back," according to Dan Wang of the Eurasia Group.

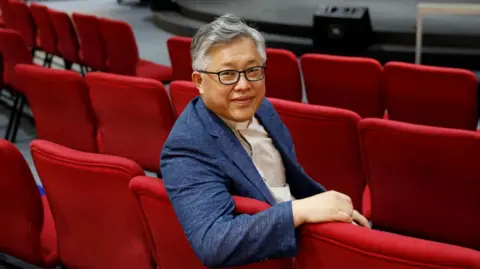

The firm, which was synonymous with China's economic growth, has become infamous for its staggering debt burden. Founded by Hui Ka Yan, who once ranked as Asia's richest individual, Evergrande is now a cautionary tale of financial overreach, dropping from a fortune of about $45 billion in 2017 to below $1 billion today. In early 2024, Hui faced a $6.5 million fine and a lifetime prohibition from participating in the capital markets due to inflated revenue claims totaling $78 billion.

At the peak of its operations, Evergrande had 1,300 projects across 280 cities, with its business empire extending into electric vehicle manufacturing and ownership of the Guangzhou FC, which faced its own financial reckoning this year. The company's downfall has roots in Beijing's 2020 regulations that restricted developers' borrowing, leading Evergrande to discount properties drastically to generate cash and inadvertently default on a number of loans. A Hong Kong High Court ordered the company's liquidation in January 2024 after it failed to devise a plan for addressing its substantial debts.

As of recent accounts, Evergrande's liabilities amount to $45 billion, having liquidated only a fraction of its assets, leading experts to conclude that a turnaround is unlikely. The repercussions of Evergrande's collapse resonate throughout China's economy, which is already grappling with issues such as escalating local government debt and diminished consumer spending. Analysts assert that the property sector's ongoing struggles—accounting for nearly a third of China's GDP—have suppressed consumption and fostered widespread layoffs in real estate.

China's authorities have started implementing various initiatives to stabilize the housing market and encourage economic revitalization, yet the country's growth has slowed to approximately 5%, a notable dip from past highs. The prospect of a recovery in the housing market remains uncertain, as further failures loom for other heavily indebted developers, suggesting that the crisis in the property sector is far from over.

While Great Wall investment firm analysts express a cautious optimism for a gradual recovery, projections indicate a continued decline in property values over the next few years. The government has adopted a cautious approach, avoiding direct bailouts for developers and instead emphasizing investments in emerging sectors like technology and green energy as part of its broader economic strategy. This marks a pivotal change in focus for the Communist Party as it aims to redefine economic growth in the coming era.

The firm, which was synonymous with China's economic growth, has become infamous for its staggering debt burden. Founded by Hui Ka Yan, who once ranked as Asia's richest individual, Evergrande is now a cautionary tale of financial overreach, dropping from a fortune of about $45 billion in 2017 to below $1 billion today. In early 2024, Hui faced a $6.5 million fine and a lifetime prohibition from participating in the capital markets due to inflated revenue claims totaling $78 billion.

At the peak of its operations, Evergrande had 1,300 projects across 280 cities, with its business empire extending into electric vehicle manufacturing and ownership of the Guangzhou FC, which faced its own financial reckoning this year. The company's downfall has roots in Beijing's 2020 regulations that restricted developers' borrowing, leading Evergrande to discount properties drastically to generate cash and inadvertently default on a number of loans. A Hong Kong High Court ordered the company's liquidation in January 2024 after it failed to devise a plan for addressing its substantial debts.

As of recent accounts, Evergrande's liabilities amount to $45 billion, having liquidated only a fraction of its assets, leading experts to conclude that a turnaround is unlikely. The repercussions of Evergrande's collapse resonate throughout China's economy, which is already grappling with issues such as escalating local government debt and diminished consumer spending. Analysts assert that the property sector's ongoing struggles—accounting for nearly a third of China's GDP—have suppressed consumption and fostered widespread layoffs in real estate.

China's authorities have started implementing various initiatives to stabilize the housing market and encourage economic revitalization, yet the country's growth has slowed to approximately 5%, a notable dip from past highs. The prospect of a recovery in the housing market remains uncertain, as further failures loom for other heavily indebted developers, suggesting that the crisis in the property sector is far from over.

While Great Wall investment firm analysts express a cautious optimism for a gradual recovery, projections indicate a continued decline in property values over the next few years. The government has adopted a cautious approach, avoiding direct bailouts for developers and instead emphasizing investments in emerging sectors like technology and green energy as part of its broader economic strategy. This marks a pivotal change in focus for the Communist Party as it aims to redefine economic growth in the coming era.