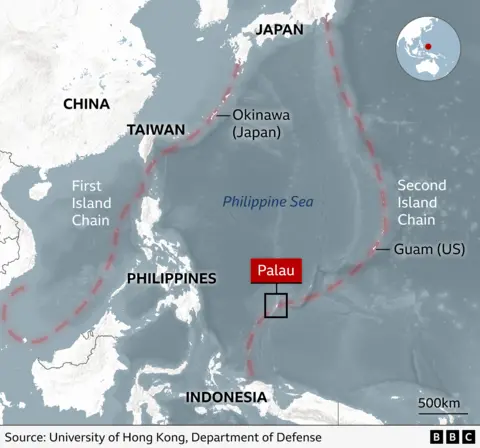

US President Donald Trump has stated intentions to impose an additional 100% tariff on imports from China, scheduled to take effect next month. This announcement came in the wake of recent actions by Beijing to tighten rules regarding exports of rare earth materials, which are vital for high-tech industries. In a series of social media posts, Trump condemned China's increasingly aggressive stance, accusing them of becoming 'very hostile' and of seeking to hold the world 'captive'. He also hinted at a potential cancellation of a meeting with Chinese President Xi Jinping, though later confirmed he would attend.

The announcement has had a notable impact on financial markets, leading to a 2.7% drop in the S&P 500, the sharpest downturn since April. Rare earths, produced mainly in China, are essential for the manufacturing of items from smartphones to electric vehicles, placing US companies reliant on these materials at risk of increased costs and supply chain disruptions.

In response to Trump's tariffs, China is taking a firmer stance as well. In addition to the new export controls on rare earths, they have launched a monopoly investigation into Qualcomm, a major US tech firm, further complicating the trade landscape. Furthermore, new port fees have been introduced that target vessels associated with the US.

While the US and China had previously reached a fragile accord to avoid drastic tariff escalations, Trump's latest decisions signal a possible breakdown in dialogue and a return to heightened tensions. Analysts suggest that negotiations may still be on the horizon despite these developments, especially with China's new restrictions not set to take effect until December.

The announcement has had a notable impact on financial markets, leading to a 2.7% drop in the S&P 500, the sharpest downturn since April. Rare earths, produced mainly in China, are essential for the manufacturing of items from smartphones to electric vehicles, placing US companies reliant on these materials at risk of increased costs and supply chain disruptions.

In response to Trump's tariffs, China is taking a firmer stance as well. In addition to the new export controls on rare earths, they have launched a monopoly investigation into Qualcomm, a major US tech firm, further complicating the trade landscape. Furthermore, new port fees have been introduced that target vessels associated with the US.

While the US and China had previously reached a fragile accord to avoid drastic tariff escalations, Trump's latest decisions signal a possible breakdown in dialogue and a return to heightened tensions. Analysts suggest that negotiations may still be on the horizon despite these developments, especially with China's new restrictions not set to take effect until December.