Chinese property behemoth Evergrande has officially been delisted from the Hong Kong stock exchange, marking a significant downturn for a company that was once emblematic of China's real estate boom. With a market valuation that soared above $50 billion, Evergrande's plummet into insolvency comes after more than 15 years of trading. Experts consider this delisting a foregone conclusion, underscoring the finality of the firm's downfall.

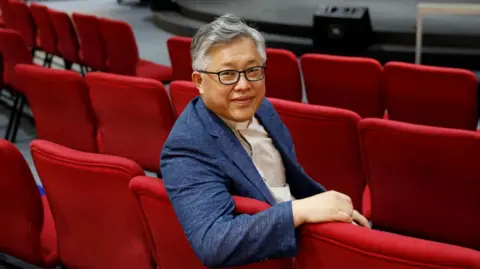

Founded by Hui Ka Yan, who once topped Forbes' list of Asia's richest in 2017, the company quickly became a key player in China's economy. However, it is now famously associated with a protracted financial crisis that has deeply affected the world’s second-largest economy. Following a $78 billion revenue inflation scandal, Hui was penalized and banned from capital markets for life, alongside ongoing investigations into his personal assets.

At the height of its crisis, Evergrande managed about 1,300 developmental projects across 280 cities and diversified into sectors including electric vehicles and football, owning the notable Guangzhou FC. However, its downfall was triggered by heavy borrowing that amassed over $300 billion, exacerbated by Beijing’s regulatory measures introduced in 2020 to rein in excessive debt among major developers.

The company was ultimately ordered into liquidation in early 2024 after failing to propose a feasible debt restructuring plan. This resulted in a staggering decline in its market value, with shares losing roughly 99% of their worth. Current liquidation efforts indicate that Evergrande is burdened by around $45 billion in debt and has only recouped $255 million in asset sales thus far.

China's economy, already suffering from various challenges including governmental debt and waning consumer confidence, is feeling the ripple effects of Evergrande’s collapse. The real estate sector, accounting for nearly one-third of the country’s economy, faces detrimental impacts due to steep property price declines—averaging reductions of at least 30%, forcing many to reconsider their investments in housing.

Government measures aimed at bolstering the property market and overall economic stimulation have surfaced, but growth has slowed significantly from over 10% a decade prior to approximately 5% today. While Beijing implements initiatives to shore up the market, analysts caution that the situation remains dire, with the potential for further collapses among neighboring property firms like Country Garden, which is grappling with foreign debt obligations.

The outlook for the market indicates that recovery will be slow, with experts predicting it may take up to two years before stability returns. As China shifts focus towards technological advancements rather than real estate, challenges facing the industry continue to mount, emphasizing a new era in the country’s economic development landscape.