The Treasury Department is increasing its examination of financial transactions between Minnesota residents and businesses in Somalia, a move announced by Secretary Scott Bessent amid heightened immigration enforcement across the state. Bessent disclosed that the department is currently investigating four businesses facilitating wire transfers abroad to scrutinize their operations further, although he refrained from naming them. This investigation aligns with ongoing protests in Minneapolis triggered by the fatal shooting of a woman by an ICE officer, which has ignited tensions between local and federal authorities.

President Donald Trump's administration has put a spotlight on the Somali community within Minnesota through strict immigration policies, leading to calls for tightening controls over financial activities related to this demographic. The recent focus of the Treasury includes specific actions such as targeting money service businesses and enhancing transaction monitoring for international money transfers originating from Hennepin and Ramsey counties, together with alerts to banks on recognizing fraud linked to child nutrition programs.

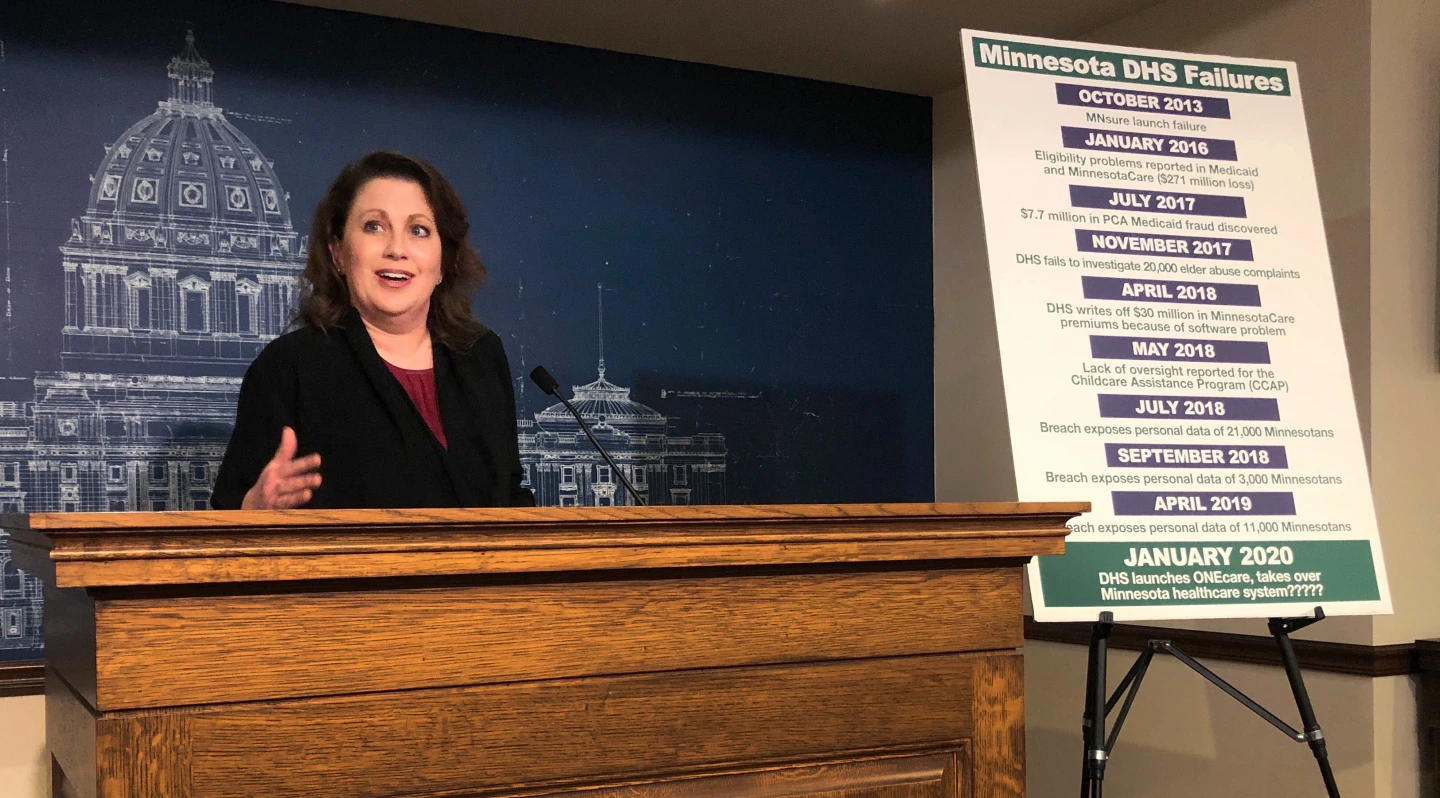

Triggered by a series of fraud cases, including the notorious Feeding Our Future nonprofit scandal—where approximately $300 million in pandemic relief funds were stolen—state officials, including Governor Tim Walz, are adamant that fraud will not be tolerated and that efforts will be made to collaborate with federal authorities for effective action.

During his address, Bessent mentioned consultations with financial institutions, urging them to implement preventive measures against fraudulent activities. However, his announcement faced backlash from some, including policy analysts expressing concern over heightened surveillance and restrictions on ordinary financial transactions.

Calls for protection from possible federal overreach have come from community leaders. Despite the heightened scrutiny, local leaders, including Governor Walz and Minneapolis Mayor Jacob Frey, have declared their support for the Somali community amid fears of growing federal enforcement.

The Treasury Department is making it clear that it plans to utilize all available resources to combat this rising trend of fraud and hold those responsible accountable.

President Donald Trump's administration has put a spotlight on the Somali community within Minnesota through strict immigration policies, leading to calls for tightening controls over financial activities related to this demographic. The recent focus of the Treasury includes specific actions such as targeting money service businesses and enhancing transaction monitoring for international money transfers originating from Hennepin and Ramsey counties, together with alerts to banks on recognizing fraud linked to child nutrition programs.

Triggered by a series of fraud cases, including the notorious Feeding Our Future nonprofit scandal—where approximately $300 million in pandemic relief funds were stolen—state officials, including Governor Tim Walz, are adamant that fraud will not be tolerated and that efforts will be made to collaborate with federal authorities for effective action.

During his address, Bessent mentioned consultations with financial institutions, urging them to implement preventive measures against fraudulent activities. However, his announcement faced backlash from some, including policy analysts expressing concern over heightened surveillance and restrictions on ordinary financial transactions.

Calls for protection from possible federal overreach have come from community leaders. Despite the heightened scrutiny, local leaders, including Governor Walz and Minneapolis Mayor Jacob Frey, have declared their support for the Somali community amid fears of growing federal enforcement.

The Treasury Department is making it clear that it plans to utilize all available resources to combat this rising trend of fraud and hold those responsible accountable.