Gold is witnessing a remarkable upswing, drawing immense interest from investors eager to secure their financial future. Emma Siebenborn, strategies director at Hatton Garden Metals, displays a modest collection of gold jewelry valued at approximately £250,000, demonstrating the everyday allure of this precious metal. The demand for gold has surged, with prices spiking over 40% in the past year, recently breaking records as it climbed above $3,500 per troy ounce.

Zoe Lyons, Emma's sister and the managing director of the dealership, notes the palpable excitement and anxiety among sellers and buyers alike. The unpredictability of the market has led to heightened trading activities as investors try to make sense of the rising prices. Factors driving this gold rush include uncertain trade policies, inflation fears, and geopolitical instability, making gold a sought-after safe haven.

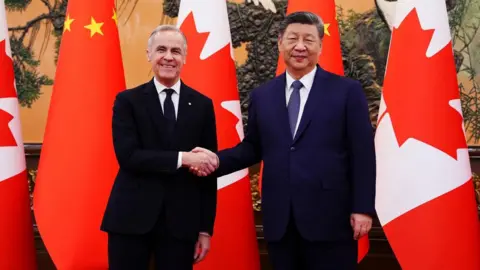

Experts like Louise Street from the World Gold Council point to central banks' increasing gold purchases as a significant factor behind the rally. Nations like China and Turkey have amassed substantial gold reserves in response to economic fears, tapping into gold's historical role as a store of value during unstable times.

However, the golden age comes with its own set of warnings. Historical trends indicate that drastic price spikes often precede sharp declines. While some analysts, like those at Goldman Sachs, predict continued climbing prices, others sound alarms about the potential for a market bubble. The past has shown that swift peaks can quickly turn into depressing troughs, leading many to ponder if today's price might soon face a significant correction.

With varied perspectives on future trends, it appears that investing in gold requires careful deliberation. Experts suggest that any investment should be part of a diversified portfolio to mitigate risks associated with short-term market fluctuations. The ongoing narrative in gold will likely shape investment strategies moving forward, blending excitement with caution as the market evolves.

Zoe Lyons, Emma's sister and the managing director of the dealership, notes the palpable excitement and anxiety among sellers and buyers alike. The unpredictability of the market has led to heightened trading activities as investors try to make sense of the rising prices. Factors driving this gold rush include uncertain trade policies, inflation fears, and geopolitical instability, making gold a sought-after safe haven.

Experts like Louise Street from the World Gold Council point to central banks' increasing gold purchases as a significant factor behind the rally. Nations like China and Turkey have amassed substantial gold reserves in response to economic fears, tapping into gold's historical role as a store of value during unstable times.

However, the golden age comes with its own set of warnings. Historical trends indicate that drastic price spikes often precede sharp declines. While some analysts, like those at Goldman Sachs, predict continued climbing prices, others sound alarms about the potential for a market bubble. The past has shown that swift peaks can quickly turn into depressing troughs, leading many to ponder if today's price might soon face a significant correction.

With varied perspectives on future trends, it appears that investing in gold requires careful deliberation. Experts suggest that any investment should be part of a diversified portfolio to mitigate risks associated with short-term market fluctuations. The ongoing narrative in gold will likely shape investment strategies moving forward, blending excitement with caution as the market evolves.