The gold price has hit another record high, trading above $4,400 (£3,275) an ounce for the first time. Analysts attribute the rise to expectations that the US central bank will cut interest rates further next year.

Gold started the year worth $2,600 an ounce, but geopolitical tensions, the Trump tariffs, and expectations of rate cuts have contributed to increased investor demand for safe haven assets, such as gold and other commodities.

The spot price of gold reached a peak of $4,420 on Monday before settling slightly lower. This marks a remarkable increase of over 68% this year, the highest growth rate since 1979, as noted by Adrian Ash, director of research at gold bullion marketplace BullionVault.

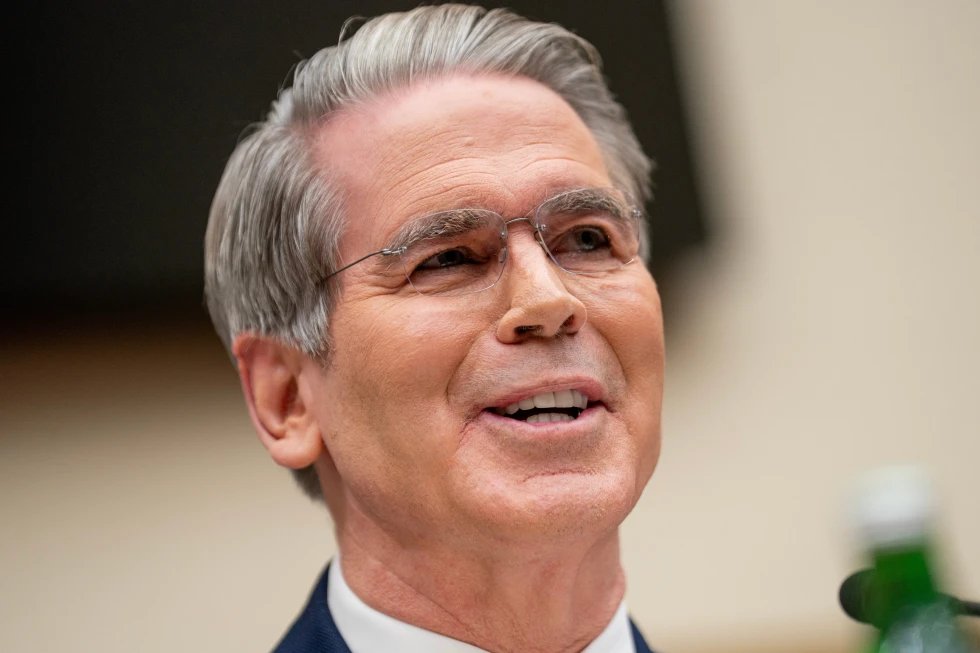

Mr. Ash remarked that trends linked to interest rates, conflict, and trade tensions, particularly those ignited by former President Trump, have significantly influenced gold's price. As interest rate expectations diminish returns on investments like bonds, investors are turning to commodities such as gold and silver for returns and portfolio diversification.

The consensus among analysts is that the US may lower interest rates twice in 2026. Central banks around the world are also increasing their physical gold holdings to counter economic uncertainty and diminish reliance on the US dollar.

Anita Wright, a chartered financial planner at Ribble Wealth Management, indicated that gold becomes a favored option for traders seeking to shield against inflation and economic instability. Factors like a weaker US dollar make gold more affordable for international buyers, further inflating its prices.

Prices for other precious metals have also surged this year, with silver hitting $69.44 an ounce and rising 138% year-to-date, while platinum reaches a 17-year high, supported by robust industrial demand. Separately, oil prices also increased following US sanctions that affected oil tankers, with Brent crude climbing to $60.99 a barrel.

Gold started the year worth $2,600 an ounce, but geopolitical tensions, the Trump tariffs, and expectations of rate cuts have contributed to increased investor demand for safe haven assets, such as gold and other commodities.

The spot price of gold reached a peak of $4,420 on Monday before settling slightly lower. This marks a remarkable increase of over 68% this year, the highest growth rate since 1979, as noted by Adrian Ash, director of research at gold bullion marketplace BullionVault.

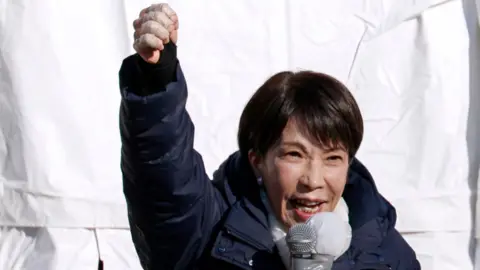

Mr. Ash remarked that trends linked to interest rates, conflict, and trade tensions, particularly those ignited by former President Trump, have significantly influenced gold's price. As interest rate expectations diminish returns on investments like bonds, investors are turning to commodities such as gold and silver for returns and portfolio diversification.

The consensus among analysts is that the US may lower interest rates twice in 2026. Central banks around the world are also increasing their physical gold holdings to counter economic uncertainty and diminish reliance on the US dollar.

Anita Wright, a chartered financial planner at Ribble Wealth Management, indicated that gold becomes a favored option for traders seeking to shield against inflation and economic instability. Factors like a weaker US dollar make gold more affordable for international buyers, further inflating its prices.

Prices for other precious metals have also surged this year, with silver hitting $69.44 an ounce and rising 138% year-to-date, while platinum reaches a 17-year high, supported by robust industrial demand. Separately, oil prices also increased following US sanctions that affected oil tankers, with Brent crude climbing to $60.99 a barrel.