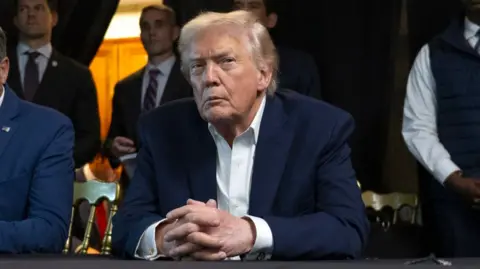

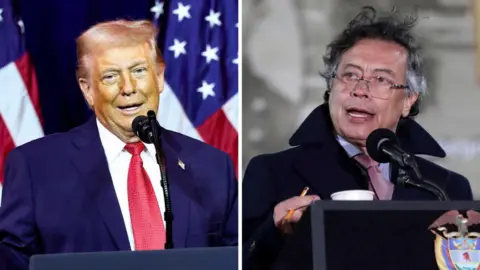

President Trump's favourite word is tariffs. He reminded the world of that in his pre-Christmas address to the nation. With the world still unwrapping the tariffs gift from the first year of his second term in office, he said they were bringing jobs, higher wages, and economic growth to the US. That is hotly contested. What is less debatable is that they've refashioned the global economy, and will continue to do so into 2026.

The International Monetary Fund (IMF) says that although the tariff shock is smaller than originally announced, it is a key reason why it now expects the rate of global economic growth to slow to 3.1% in 2026. A year ago, it predicted a 3.3% expansion this year. For the head of the IMF, Kristalina Georgieva, things are better than we feared, worse than it needs to be. Speaking on a podcast recently, she explained that growth had fallen from a pre-Covid average of 3.7%.

Yet the impact of the tariffs on the global economy was not as bad as it could have been, notes Maurice Obstfeld of the Peterson Institute for International Economics, who is also a former chief economist at the IMF. He says this is the case because countries didn't retaliate strongly against the US. However, after five rounds of trade talks, the world's two biggest economies still have more tariffs and other trade restrictions in place against each other than when Trump took office for the second time. The tariffs have pushed up costs for many businesses and increased uncertainty, which makes it harder to plan for and invest in the future.

Despite the resilience seen so far, these frictions and uncertainties take their toll over time. Some of the damage of tariffs has been mitigated by lower interest rates, a fall in the value of the dollar, businesses finding clever ways around them, and, crucially, the many exemptions they contain.

Countries including the UK, South Korea, and Japan have managed to navigate those mysteries and agree trade deals with Trump. Others will hope they can do so during 2026. Meanwhile, the global economy is also influenced by oil prices, with Goldman Sachs expecting a fall in price due to strong production in the U.S. and Russia. Overall, the impending tariffs and trade dynamics will continue to shape the future of the global economy into 2026.

The International Monetary Fund (IMF) says that although the tariff shock is smaller than originally announced, it is a key reason why it now expects the rate of global economic growth to slow to 3.1% in 2026. A year ago, it predicted a 3.3% expansion this year. For the head of the IMF, Kristalina Georgieva, things are better than we feared, worse than it needs to be. Speaking on a podcast recently, she explained that growth had fallen from a pre-Covid average of 3.7%.

Yet the impact of the tariffs on the global economy was not as bad as it could have been, notes Maurice Obstfeld of the Peterson Institute for International Economics, who is also a former chief economist at the IMF. He says this is the case because countries didn't retaliate strongly against the US. However, after five rounds of trade talks, the world's two biggest economies still have more tariffs and other trade restrictions in place against each other than when Trump took office for the second time. The tariffs have pushed up costs for many businesses and increased uncertainty, which makes it harder to plan for and invest in the future.

Despite the resilience seen so far, these frictions and uncertainties take their toll over time. Some of the damage of tariffs has been mitigated by lower interest rates, a fall in the value of the dollar, businesses finding clever ways around them, and, crucially, the many exemptions they contain.

Countries including the UK, South Korea, and Japan have managed to navigate those mysteries and agree trade deals with Trump. Others will hope they can do so during 2026. Meanwhile, the global economy is also influenced by oil prices, with Goldman Sachs expecting a fall in price due to strong production in the U.S. and Russia. Overall, the impending tariffs and trade dynamics will continue to shape the future of the global economy into 2026.