U.S. Treasury Secretary Scott Bessent has said the U.S. is ready to do what is needed to help stabilize Argentina's escalating financial turmoil.

All options for stabilization are on the table, Bessent wrote on social media, calling Argentina a systematically important U.S. ally in Latin America. The message helped to calm financial markets, which have been rattled as recent election losses raise doubts about the future of Javier Milei's cost-cutting, free-market agenda. The value of the peso has been plunging, while investors dump Argentine stocks and bonds.

Milei, a libertarian economist and ally of U.S. President Donald Trump, was elected president of Argentina in 2023 as an outsider candidate who promised to control soaring inflation through radical government spending cuts and other reforms. A stable Argentine peso is critical to that pledge, but the currency has lost value as investors move money out of the country, in part worried about the government's ability to keep the peso steady.

In recent weeks, the Argentine central bank has stepped in to try to stave off further weakness in the peso. However, that effort, which included spending $1.1 billion of its reserves last week to buy pesos, also depleted its holdings, putting the country in a more precarious position when it comes to paying back its debt.

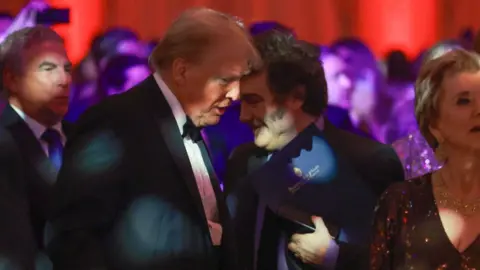

Bessent said the U.S. government was considering intervening in Argentina's current fiscal turmoil with purchases of Argentine pesos and dollar-denominated government debt among other forms of support. More details will be announced after President Trump meets with Milei in New York on Tuesday, he added.

Milei expressed enormous gratitude for the U.S.'s pledge of support, which helped lift Argentine stocks and prices for the country's dollar-denominated debt.

All options for stabilization are on the table, Bessent wrote on social media, calling Argentina a systematically important U.S. ally in Latin America. The message helped to calm financial markets, which have been rattled as recent election losses raise doubts about the future of Javier Milei's cost-cutting, free-market agenda. The value of the peso has been plunging, while investors dump Argentine stocks and bonds.

Milei, a libertarian economist and ally of U.S. President Donald Trump, was elected president of Argentina in 2023 as an outsider candidate who promised to control soaring inflation through radical government spending cuts and other reforms. A stable Argentine peso is critical to that pledge, but the currency has lost value as investors move money out of the country, in part worried about the government's ability to keep the peso steady.

In recent weeks, the Argentine central bank has stepped in to try to stave off further weakness in the peso. However, that effort, which included spending $1.1 billion of its reserves last week to buy pesos, also depleted its holdings, putting the country in a more precarious position when it comes to paying back its debt.

Bessent said the U.S. government was considering intervening in Argentina's current fiscal turmoil with purchases of Argentine pesos and dollar-denominated government debt among other forms of support. More details will be announced after President Trump meets with Milei in New York on Tuesday, he added.

Milei expressed enormous gratitude for the U.S.'s pledge of support, which helped lift Argentine stocks and prices for the country's dollar-denominated debt.