The US and EU have reached a significant trade agreement in Scotland, touted as potentially the largest in history. Although still lacking comprehensive details, initial figures presented by President Trump and EU leader Ursula von der Leyen offer insights into the potential impacts across different sectors.

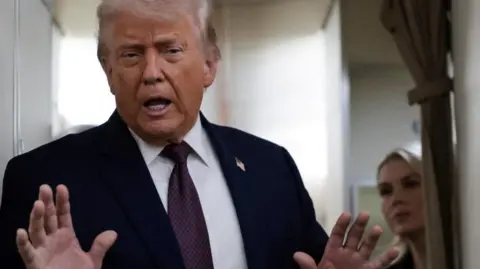

**Trump Emerges as a Winner**

In a move that reinforces his administration's focus on renegotiating trade agreements, Trump has successfully sealed a vital deal that analysts believe leans in favor of the US. The EU's concessions could result in a 0.5% reduction in GDP for the bloc, with the US expected to gain tens of billions from new import tariffs. However, the long-term benefits for Trump may hinge on upcoming economic data that could reveal negative impacts of his trade strategies on the US economy.

**Consumers Face Adverse Effects**

For average Americans, the deal may not be as favorable. Rising prices on imported EU goods could exacerbate an already high cost of living. While tariffs are lower than anticipated, the 15% rate remains a significant burden that will likely be passed on to consumers.

**Market Confidence Rises**

Stock markets in Asia and Europe reacted positively to news of the framework agreement. Although the proposed 15% tariff is substantial, its relative certainty is viewed as beneficial for investor confidence, potentially boosting the euro's value.

**EU's Internal Divisions Surface**

The deal’s acceptance is far from unanimous within the EU, as varying interests among its 27 members complicate consensus. Some members express concern over the negotiations, reflecting tensions within the bloc that are compounded by other simultaneous crises, including those stemming from the war in Ukraine.

**Impact on European Carmakers**

The tariff adjustments have caused concern for the EU's automotive sector. While the tariff on EU cars imported into the US has significantly decreased from 27.5% to 15%, industry representatives warn that such rates will still lead to substantial financial losses for German car manufacturers, a key sector of the EU economy.

**US Automakers See Opportunity**

Conversely, US car manufacturers may benefit from the EU's decrease in tariffs on American-made vehicles, which could open up new sales avenues in Europe. However, complexities in production and existing tariffs could pose challenges for domestic sales.

**Mixed Signals for Pharmaceuticals**

The pharmaceutical sector in Europe faces uncertainty following contradictory messaging about tariffs on drugs. EU leaders hope for lower rates, but assurances have proved elusive, raising questions about the future of this lucrative market.

**Energy Sector Gains from Deal**

A key highlight is the announcement that the EU will ramp up purchasing of US energy resources, bolstering economic ties and enhancing European energy security as it shifts away from Russian oil and gas.

**Strategic Advantages for the Aviation Industry**

Positive developments were noted for the aviation sector, with certain strategic products exempt from tariffs, promising ease of trade for aircraft components between the US and EU.

As the details of the trade agreement unfold, stakeholders will closely monitor its implications across the economy, with both opportunities and challenges on the horizon.