The timing aligns with a resurgence in US stock markets, with both the S&P 500 and Nasdaq Composite reaching record highs. UMG has submitted a confidential statement to the Securities and Exchange Commission (SEC), though it hasn't disclosed any details regarding the offering's size or projected revenue. This confidential process allows UMG to gauge investor interest and refine its plans before public disclosure of further information.

Billionaire investor Bill Ackman, with a substantial stake in UMG through his hedge fund Pershing Square, has been advocating for the US listing, asserting that it would enhance UMG’s market liquidity and valuation.

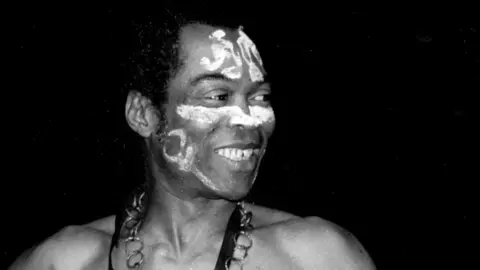

UMG houses renowned labels including Motown Records and Capitol Music Group, which has represented legendary figures such as Marvin Gaye and The Beatles. The company also previously navigated a significant dispute with TikTok regarding music royalties, which culminated in a resolution in May 2024.

As UMG prepares for this step towards an IPO, the music industry will closely monitor the unfolding developments, which could reshape the landscape of music investment and artist promotion moving forward.

Billionaire investor Bill Ackman, with a substantial stake in UMG through his hedge fund Pershing Square, has been advocating for the US listing, asserting that it would enhance UMG’s market liquidity and valuation.

UMG houses renowned labels including Motown Records and Capitol Music Group, which has represented legendary figures such as Marvin Gaye and The Beatles. The company also previously navigated a significant dispute with TikTok regarding music royalties, which culminated in a resolution in May 2024.

As UMG prepares for this step towards an IPO, the music industry will closely monitor the unfolding developments, which could reshape the landscape of music investment and artist promotion moving forward.