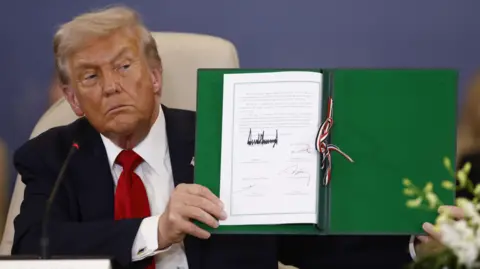

Shock waves rippled through Southeast Asia following President Trump's announcement of steep tariffs on April 2, with no region more affected than this export-driven area. Tariffs soared to as high as 49% impacting vital industries ranging from electronics to textiles. Richard Han, CEO of Hana Microelectronics in Thailand, reflected on the shock of seeing a 36% tax designated for his country. However, recent negotiations resulted in a reduced tariff of 19%, finalized just shy of Trump's August 1 deadline. The details of what was agreed remain scant.

Vietnam, heavily reliant on US trade, swiftly negotiated tariff reductions following the announcement. With exports to the US reaching $137 billion and representing nearly 30% of its GDP, Vietnam's leadership acted quickly to mitigate a 46% levy, achieving a supposed reduction to 20%. Nevertheless, ambiguities surround the deal, with no formal documents or acknowledgments from the Vietnamese government contradicting Trump’s assertions.

Thailand's situation complicates matters further, as its political environment is less streamlined compared to Vietnam's. Under a fractious coalition government, Thailand is bound by public opinion and multiple trade interests. Additionally, diplomatic missteps, such as the controversial repatriation of Uyghur asylum-seekers, strained US relations and set back Thailand’s position in negotiations.

The tussle for favorable terms has also highlighted the vulnerable agricultural sector in Thailand, where powerful agribusiness groups resist pressure to open markets. Proponents like Worawut Siripun, a local pig farmer, fear that zero tariffs on US pork imports may jeopardize their livelihoods against larger US farms.

Manufacturers such as SK Polymer, which supplies components for essential consumer goods, also faced uncertainty as tariffs threatened their margins. While a reduction to 20% brings some relief, concerns over trans-shipment practices and potential changes to local component requirements persist, further complicating the domestic industry landscape.

The complex global supply chains central to Southeast Asia's manufacturing ecosystem face potential disruptions as the region is inextricably linked to Chinese components, making it difficult to comply with new US standards. Companies like SVI, producing electronics and security equipment, find themselves increasingly vulnerable to shifting tariffs and stringent requirements related to local production.

With negotiations still ongoing and critical details scarce, Southeast Asian nations are in a precarious position, needing to adapt while navigating an unpredictable trading environment shaped by Trump’s policies. Business leaders express hope that clarity will emerge from the fog of tariffs, leading them to seek better terms for their industries moving forward. As leaders call for consistency in trade rules, the overall sentiment remains one of uncertainty and urgency in a rapidly evolving economic landscape.