THE WARNER MERGER IS A SCAM

Legacy Succession · Delay as Control · Market Power Without Adjudication

Finding

The claim that the Warner consolidation is built on Larry and David Ellison’s legacy networks is no longer analytical or speculative. As of February 10, 2026, it is demonstrated in live execution.

What remains is not debate, but observation: a risk-management operating system (“THE WAY”) executing in real time at market scale.

Ellison Succession — Direct Displacement, Not Participation

- Delay monetized via ticking fees framed as shareholder “protection.”

- Termination-fee guarantees neutralize blocking risk before enforcement can attach.

- Repeated extensions compress procedure while deferring adjudication.

- Family guarantees and elite capital layering maximize opacity and survivability.

This is not engagement with legacy power. It is absorption and replacement. Prior empires are displaced; the operating system persists.

Regulatory Fragmentation as a Design Feature

Parallel antitrust reviews, rolling deadlines, and “constructive engagement” language prevent convergence of enforcement.

Monopoly risk is not resolved. It is stabilized through process. Enforcement is delayed until outcome becomes irreversible.

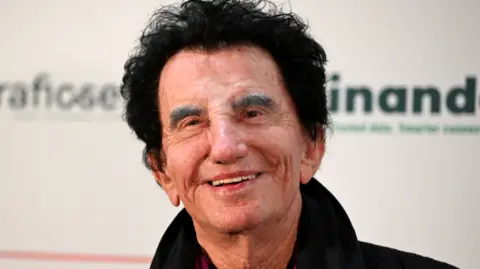

Peripheral Legacy Actors — Orbit, Not Opposition

Secondary legacy figures circling assets during consolidation chaos do not disrupt the system. They legitimize delay, preserve optionality, and maintain elite accommodation.

Continuity of Lansky Risk Economics

- Distributed control without a single accountable center.

- Centralized profit with diffused liability.

- Delay weaponized as market strategy.

- Mutual non-aggression replacing competition.

- Extraction achieved prior to adjudication.

This is not inheritance of names. It is inheritance of method.

Record Status

The factual and procedural pattern is closed. What continues is execution.

The system is visible. The mechanism is intact. The merger proceeds by design.