Tesla boss Elon Musk has become the first person ever to achieve a net worth of over $500bn (£370.9bn), as the value of the electric car company and his other businesses have risen this year.

The tech magnate's net worth briefly reached $500.1bn on Wednesday afternoon New York time, before dipping slightly to just over $499bn later in the day, according to the Forbes billionaires index.

Alongside Tesla, valuations of his other ventures, including the artificial intelligence start-up xAI and rocket company SpaceX, have also reportedly climbed in recent months.

The milestone further cements Musk's status as the world's richest person, well ahead of rivals in the global tech sector.

According to Forbes' billionaires index, Oracle founder Larry Ellison is the world's second richest person, with a fortune of about $350.7bn.

Mr. Ellison briefly overtook Musk last month after shares in Oracle soared by more than 40%, buoyed by the firm's promising outlook for its cloud infrastructure business and AI deals.

Musk's massive wealth is closely tied to his over 12% stake in Tesla, which has seen significant share price increases this year.

Tesla shares were more than 3.3% higher at the end of New York trading on Wednesday and have now risen over 20% this year, fueled by investor confidence due to Musk's renewed focus on his businesses rather than political engagements.

Previously, Musk faced criticism for his involvement with the Trump administration's Department of Government Efficiency (DOGE), meant to reduce federal spending and jobs.

He has also been vocal about various social issues, including immigration and diversity initiatives.

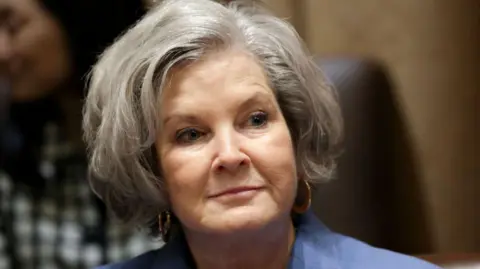

Robyn Denholm, chair of Tesla's board, stated in September that Musk is now 'front and centre' in the company, with plans for him to receive a potential pay package worth over $1 trillion if he meets ambitious targets in the coming decade.

Musk would need to significantly enhance Tesla’s value, sell AI robots, and sell millions more cars to achieve these goals.

Recently, he announced a $1bn purchase of Tesla shares, viewed by many investors as a show of confidence in the company.

Despite challenges from rival electric vehicle makers like BYD, Tesla is navigating a shift towards becoming an AI and robotics business.