Electronic Arts (EA), one of the biggest gaming companies in the world, has agreed a deal to sell the company for $55bn (£41bn).

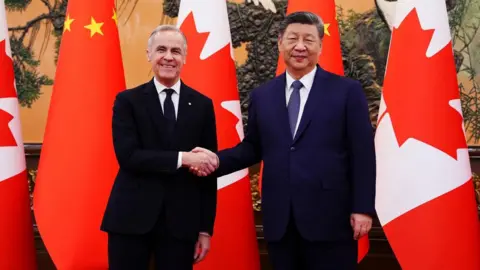

The consortium of buyers includes Saudi Arabia's Public Investment Fund (PIF), Silver Lake, and Jared Kushner's Affinity Partners.

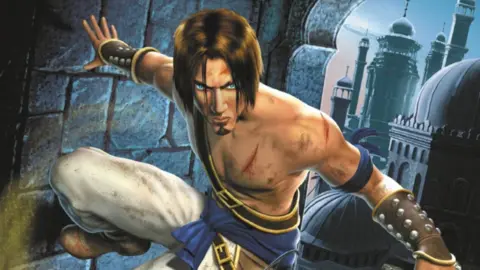

EA is known for making and publishing best-selling games such as EA FC, formerly known as FIFA, The Sims, and Mass Effect.

This acquisition is currently regarded as the largest leveraged buyout in history, implying a significant amount of the purchase is financed through borrowed money.

The deal will take EA private, meaning all of its public shares will be purchased, and it will no longer be traded on a stock exchange.

The purchase price places a notable 25% premium on EA's market value, equating to $210 per share.

Remarkably, it's the second most valuable gaming acquisition ever, following Microsoft's $69bn acquisition of Activision Blizzard amidst regulatory scrutiny.

EA's CEO Andrew Wilson will remain in his position and has described the acquisition as a powerful recognition of the company's work.

Experts suggest that while the purchase can potentially elevate EA, it also poses risks due to over $20 billion in debt that may pressure the company to focus on cash flow, possibly hindering new game investments.

Meanwhile, the deal represents a strategic expansion into the gaming industry for Saudi Arabia, which has heavily invested in this sector in recent years, acquiring stakes in several leading gaming organizations.