President Donald Trump has stated that it is "highly unlikely" he will dismiss Jerome Powell, the head of the US central bank, following inquiries with lawmakers about the possibility. Stock markets and the US dollar saw brief declines after the news circulated, yet quickly recovered as Trump downplayed the discussions.

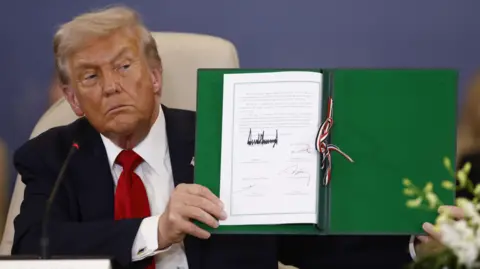

Dismissing Powell would break with historical precedent, especially considering Trump has publicly urged him to lower interest rates throughout his presidency. In a White House statement, Trump acknowledged recent discussions about Powell's position but emphasized, "We're not planning on doing anything." When pressed on the potential of an actual dismissal, he said, "It's highly unlikely unless he has to leave for fraud."

The president's allies have joined in criticizing Powell, particularly over the renovation costs of Federal Reserve properties. Last week, budget director Russell Vought called for an investigation into alleged cost overruns on a $2 billion renovation project in Washington, which Trump described as "sort of" a fireable offense.

Financial analysts from Deutsche Bank noted the escalation in attacks against Powell might indicate that the administration is constructing a case against him. They observed that while President Trump may not act immediately, the risks associated with Powell's position seem to be growing.

The Federal Reserve operates independently as established by Congress, with Powell's term ending in May next year, although he can continue serving as a governor until 2028. Under federal law, the president can remove Fed governors "for cause," typically implying significant misconduct. Powell has asserted his intention to complete his term, maintaining that Trump cannot dismiss him based solely on policy disagreements.

Responding to the renovations, the Fed updated its website, claiming the renovations would ultimately result in cost savings and attributing increased expenses to unforeseen conditions. Trump has previously expressed frustration over Powell's decisions, particularly regarding interest rates.

As elections approach, prominent Republicans have hinted at Powell's potential firing; however, Trump has generally backtracked on such ideas due to investor apprehension. Recently, Congresswoman Anna Paulina Luna suggested on social media that a dismissal might be imminent, echoing sentiments from other Trump allies in recent weeks.

The White House's escalating aggression towards a key independent institution reflects a concerning trend, especially amid global economic instability exacerbated by Trump's trade wars. Powell has a critical role in determining interest rates, which significantly influence economic borrowing costs. Currently, the key interest rate stands around 4.3%, a decrease from last year, but not as rapidly lowered compared to other central banks, which has troubled Trump.

Economists warn that political interference in the Fed's leadership could jeopardize market stability. Jamie Dimon, CEO of JPMorgan Chase, has stated that meddling with the Federal Reserve may yield adverse outcomes. Meanwhile, Treasury Secretary Scott Bessent confirmed that a "formal process" is in place to consider potential replacements for Powell, whom Trump has previously mentioned as a candidate. Other names include Kevin Hassett and Kevin Warsh.

Powell was appointed by Trump in 2017 and continued under former President Joe Biden's administration.